What is the Inflation Reduction Act?

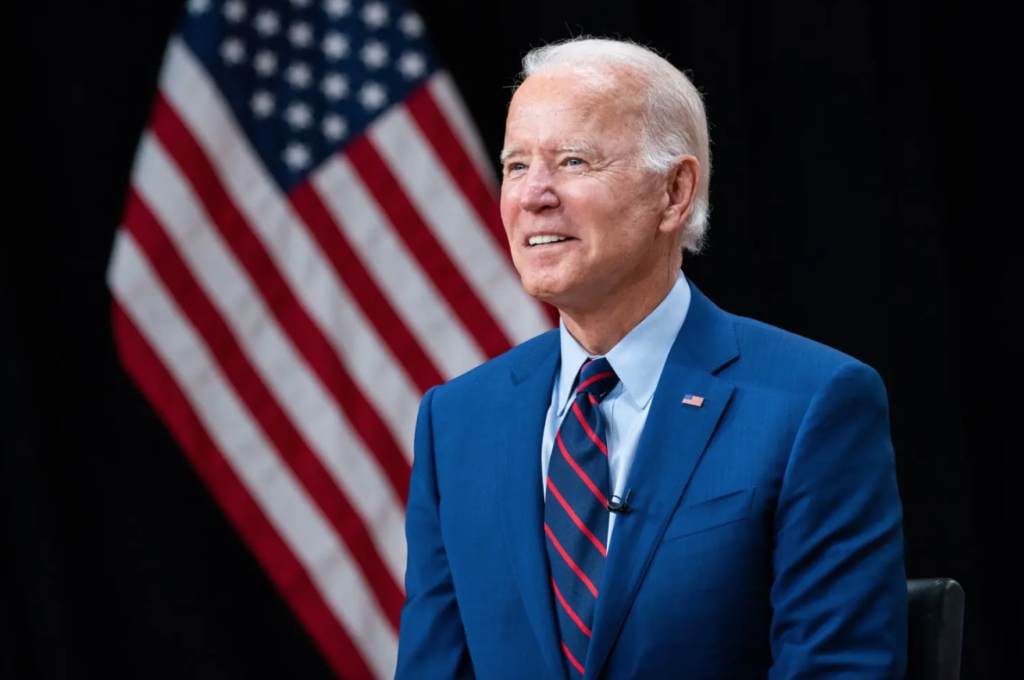

(Sustainabilityenvironment.com) – US President Joe Biden signed the Inflation Reduction Act on August 16, 2022. The act includes significant investments to make healthcare and prescription drugs more accessible, increasing taxes for wealthy companies. But above all it represents the first great federal climate law of the last 30 years (and beyond) of history stars and stripes. The text reserves almost 370 billion dollars for the fight against emissions and energy security in the country.

A greatly reduced and revised version of Biden’s Build Back Better bill, proposed in 2020, the Inflation Reduction Act is the result of an unexpected compromise between the Democrats in Congress. The measure passed the chamber with only 220 favorable against 207 against. Once the law comes into force, it will increase federal revenue from a number of key sectors, allocating revenue primarily to health and the environment.

For the green policies of the United States, this is the first major move on the track toward the decarbonization of the country. In detail, the Inflation Reduction Act offers tax credits on investment and production, loans, and policies to support mature energy sectors, such as photovoltaics and wind. At the same time, it also encourages new technologies such as hydrogen and CCUS (CO2 capture, storage and reuse), albeit on a small scale.

Electric cars and CO2

Not only. The Act also reviews and expands tax credits for electric vehicles by providing up $4,000 for the purchase of used electric cars and $7,500 for the purchase of some new electric vehicles. Spend $9 billion on discount programs for more efficient or environmentally friendly appliances. It allocates $6 million to reduce emissions related to steel, cement and chemical production. It imposes new taxes for the release of methane by the production, treatment and storage of hydrocarbons. Strengthen climate resilience and protect nearly 2 million acres of national forests.

“Congress – explains BloombergNEF – has been trying [to pass] a federal climate law for almost three decades, including the price of carbon. This time, the Democrats abandoned political approaches based on the “stick” and offered “carrots” to enhance the implementation of clean energy technology. The new bill represents an unprecedented US climate commitment. It offers nearly four times as much clean energy funding as the Recovery Act of 2009. Since the costs of climate solutions equipment have decreased rapidly since then, the impact of this new bill should be more than four times greater”.

Clean energy, the effects of the Inflation Reduction Act

According to the White House, the new provisions will result in a reduction in greenhouse emissions of 1 gigaton by 2030. And the installation of 950 million solar panels, 120,000 wind turbines and 2,300 battery plants on a grid scale.

But what does the text on the renewable side provide for?

The Production Tax Credit (Production Tax Credit – PTC) is extended to projects (wind, solar, geothermal, biomass, hydroelectric) built between 1 January 2022 and 1 January 2025. The extended PTC is reduced from 1.5 cents/kW to a base amount of 0.3 cents/kW in the case of projects above 1 MW that do not meet precise wage and engagement requirements. A further 10% “bonus” is available if the developer is able to certify that certain steel, iron or manufactured products that are part of the plant have been produced in the United States or if the project is in an “energy community“.

The Investment Tax Credit (ITC) is extended for ten years. For facilities that begin construction before January 1, 2025, the bill extends the ITC up to 30% of the cost of installed equipment for ten years and then will drop to 26% in 2033 and 22% in 2034. It also extends credit to storage systems with a capacity of at least 5 kWh.

The law creates several tax credits on advanced manufacturing production for some components of clean energy, for 10 years such as: thin film photovoltaic cells or crystalline photovoltaic cells, photovoltaic wafers, solar grade polysilicon, Polymer backsheet and solar modules.

The Clean Electricity Investment Tax Credit (CEITC) is introduced for any investment in a qualified facility that produces emission-free electricity and storage facilities put into service after 31 December 2024. The CEITC has a basic credit of 6% plus specific bonuses.