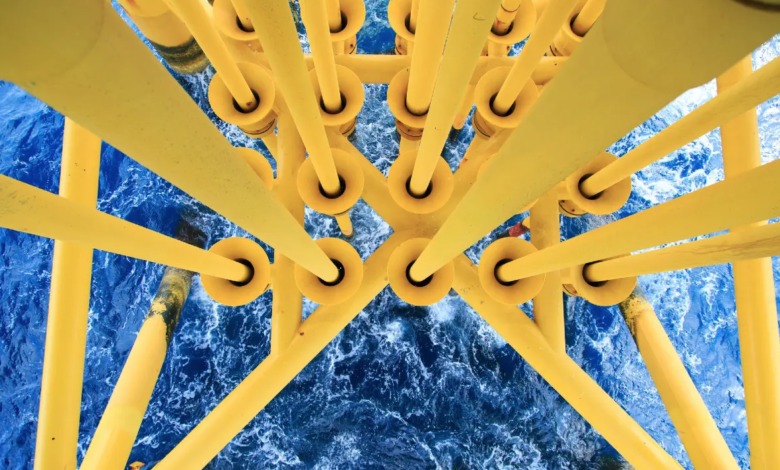

UK will give “hundreds” of new licenses for oil and gas exploitation in North Sea

Only the 1st round should award over 100 licenses

Covered by the umbrella of “energy independence“, the British government has confirmed that it intends to expand oil and gas exploitation in the North Sea by granting at least 100 new licenses only for the first round of auctions. In the future, the government could allocate hundreds more. A choice that the executive defends as better for the environment than the alternatives, despite the evaluations of several scientific bodies saying the opposite.

UK plans for oil and gas exploitation

According to Prime Minister Rishi Sunak, the choice to extract more hydrocarbons from the North Sea basins is a choice that does not clash with the London transition strategy. In 2021, a few months before hosting COP26 in Glasgow, Scotland, the government led by Boris Johnson had raised the emissions reduction target to -78% by 2035. But for Sunak there would be no problems with more oil and gas exploitation simply because in the roadmap it is expected that in 2050, when Britain should achieve climate neutrality, about 25% of the national energy demand is still covered by fossils.

Read also London announces it will not meet its climate commitments by 2030

However, both a study by the International Institute for Sustainable Development and a roadmap for the transition drawn up by the International Energy Agency (IEA), argue that starting new oil and gas wells is incompatible with maintaining the global temperature below the threshold of 1.5 degrees.