Marine microplastics, what if the ships aspirate them?

Naval scrubbers can help combat marine microplastics

(Sustainabilityenvironment.com) – According to the association Plastic Europe, 368 million tonnes of plastic were produced in 2019 worldwide, and around 3%, or 11.4 million tonnes, of this plastic ultimately ends up in the ocean feeding the problem of marine microplastics. Once in the water, in fact, these wastes are progressively breaking down, degrading and dispersing in the form of very small particles from the surface to the bottom of the sea. And increasing their bioavailability for all marine organisms.

To address a problem, the Grimaldi Group – an Italian multinational operating in the field of marine transports and logistics – has planned, tested and patented a new filtering system. The device was created to transform ships into real “vacuum cleaners of the sea“. And to do so through a strongly integrated approach. The filtering system has been inserted, in fact, at the level of the naval scrubbers, equipment that allows reducing the exhaust gases.

These are particular washing towers capable of removing sulfur oxides and breaking down sulfur dioxide, hydrocarbons, heavy metals and other pollutants produced by diesel engines of large ships. The scrubbers take huge amounts of water every day and then put it back into the sea; a 10 MW engine needs about 450 cubic meters of water per hour to clean its drains.

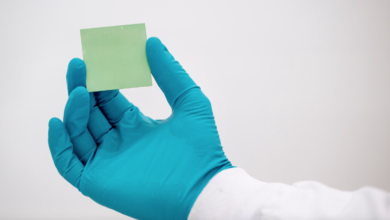

Thanks to Grimaldi’s new filtering systems, the marine microplastics present are directly retained from the water taken. According to the first test results, the device efficiently captures even particles smaller than 10 µm.

“It is a pleasure to continue our long relationship with Grimaldi and announce this innovation”, said Tamara de Gruyter, President Marine Systems of Wärtsilä.

“Microplastics are a pressing environmental challenge and we’re proud to work together with Grimaldi to tackle cleaning up the oceans. Even more importantly, the ability to capture microplastics shows how scrubbers are a platform for solving a wide range of sustainability challenges – and now even ones that are beyond the stack”.

“Reducing microplastics pollution in our world’s oceans is an important challenge, and we are pleased to provide a solution for the shipping industry. The idea for this innovative technology originated from recognising that open loop exhaust gas cleaning systems can draw seawater for exhaust scrubbing and simultaneously collect microplastic present in the oceans as part of their normal operation”, commented Emanuele Grimaldi, managing director of the Grimaldi Group.

“We have already completed pilot testing of this system onboard one of our vessels deployed between Civitavecchia and Barcelona. The results are promising, with 64,680 microplastic particles collected on a single voyage between these two ports. We are glad that Wärtsilä also recognises the potential of this system, and we look forward to further collaboration to tackle microplastics in our oceans”, Emanuele Grimaldi added.