Sustainable photovoltaics, how to grow solar energy without “making mistakes”

Seven moves to accelerate sustainable photovoltaics in Europe and ensure that the energy transition respects nature and society. To propose a consortium of realities from the world of environment and energy. Birdlife Europe and Central Asia, CEE Bankwatch Network, CAN Europe, European Environmental Bureau, EuroNatur and Solarpower Europe yesterday issued a joint statement to highlight what should be the EU priorities in solar development.

The European Commission has widely acknowledged the contribution of photovoltaics to the Community decarbonisation process and has set important objectives for this sector: a capacity of 400 GW for 2025, to be increased to 700 GW by 2030. “Solar energy needs a massive increase,” explains Ariel Brunner, deputy director of BirdLife Europe and Central Asia. “For the energy transition to be a success, it is necessary to speed up permits without compromising effective safeguards for people and biodiversity”. “For this transformation to succeed, climate, energy and biodiversity policies will need to be examined holistically and mutually reinforcing,” added Seda Orhan, Renewable Energy Campaign Coordinator, CAN Europe.

Seven key demands for sustainable solar

The six companies highlighted in their statement seven key actions to ensure the growth of a sustainable photovoltaic, in a path that rewards speed but also quality.

In detail, the consortium calls for the rapid designation of priority areas with lower environmental impact for the rapid deployment of solar projects and for a sufficient number of experts to be allocated to permit procedures at local and national level. But also to simplify the authorization procedures, primarily for photovoltaics in construction, to make the network an essential element of planning and permitting, to ensure maximum compliance with existing environmental legislation. All this by involving citizens and local communities and not retreating a step back on the target of 45% of renewables in 2030 consumption.

The associations also clarify their vision of “priority areas”, ie those areas that according to the EU Executive should allow a rapid and facilitated growth of renewables. For signatories, these areas should be designated first (one year after the entry into force of the Directive) by including:

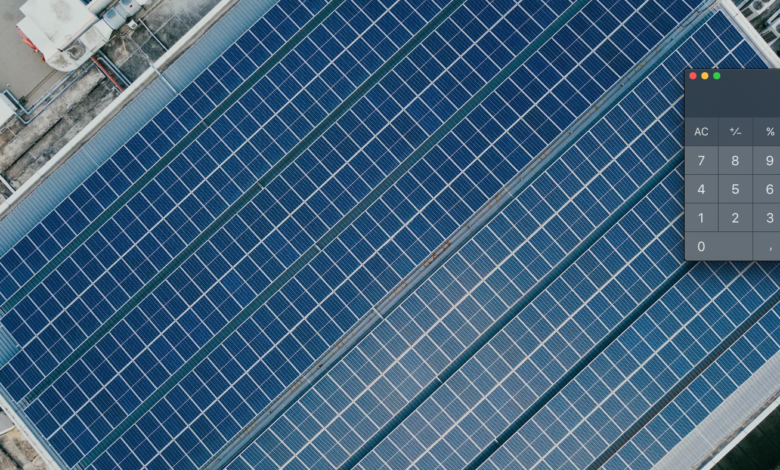

- Car parks, roofs, transport infrastructure, industrial sites or publicly owned land, e.g. near transport areas, built-up areas in military zones or in any other artificial structure.

- Carefully designated low-biodiversity areas not intended for nature restoration measures (including agricultural land).

- Areas where agri-voltaic projects have positive impacts on the surrounding nature.

“Solar and biodiversity protection go hand in hand, and the versatility of this technology is a key factor for citizens’ energy participation,” said Jonathan Bonadio, senior policy advisor at SolarPower Europe. “This statement is a key tool to accelerate sustainable solar distribution”.